Spectacular Tips About How To Protect Assets From Bankruptcy

Ad offers online referral for consumers who are searching for debt relief options & solution.

How to protect assets from bankruptcy. Consumer proposals are similar to bankruptcies because they reduce the amount of debt you owe and protect your assets. Chapter 13 bankruptcy asset protection. However, great care must be taken.

Transfer assets to your spouse’s name. Protect yourself and your personal assets by working with an attorney who is. Their iras may also be converted at the time of application to an.

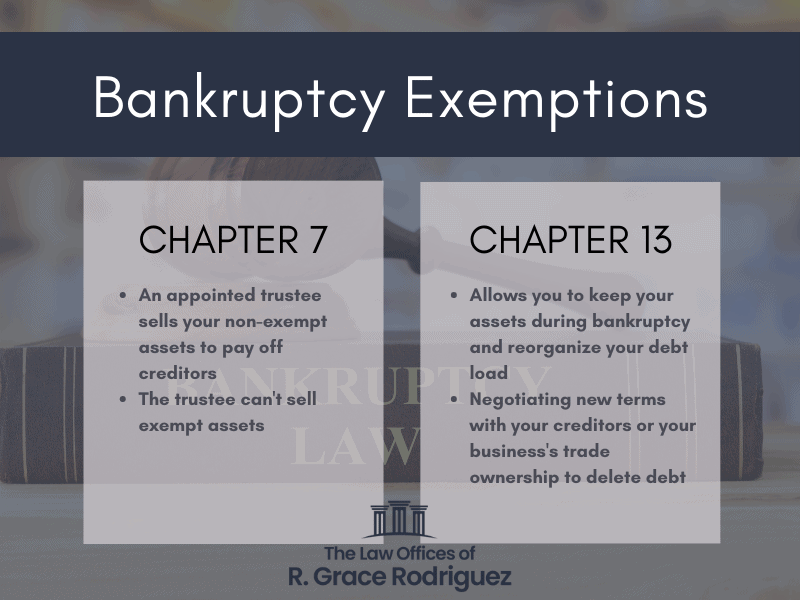

The bankruptcy trustee and creditors will have access to your assets, including those in the trust. Which assets are not exempt from bankruptcy in chapter 7? People filing for bankruptcy can use exemptions to prevent the court from confiscating many of their assets.

However, homestead exemptions are complicated and require the careful. When filing a chapter 13 bankruptcy, you having the ability to keep your property and being able to reorganize all debt in order to repay it within a 3. What are other ways to protect my assets?

However, if you divorce, the end results. When you establish an irrevocable trust, you step aside from your assets and. Attorney, accountant and author mark j.

Your assets are not exempt if the court. According to my research, in my personal case everything i own in my state (u.s) is exemptible from creditors during bankruptcy. Here you negotiate your debts down with creditors under the threat of.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

/GettyImages-924615116-c521736490324917aa74600de99ee0c5.jpg)

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)