Looking Good Tips About How To Apply For Lifetime Learning Credit

How to claim the lifetime learning credit.

How to apply for lifetime learning credit. See our credit card offers & find one that works for you—get started and apply online! Apply for a credit card now. Claiming the lifetime learning credit requires filing irs form 8863 with your tax return.

The first step should be to check your magi. Claim the tax credits & deductions you deserve. File to apply for your tax credits.

You already claimed or deducted another higher education benefit using the same student or same. For the lifetime learning credit, you can qualify if you take the course to acquire or improve your job skills. How to apply for lifetime learning credit.

Start your tax filing today! Apply for a credit card now. Lifetime learning credit (llc) is another excellent opportunity to obtain some additional money over your tax.

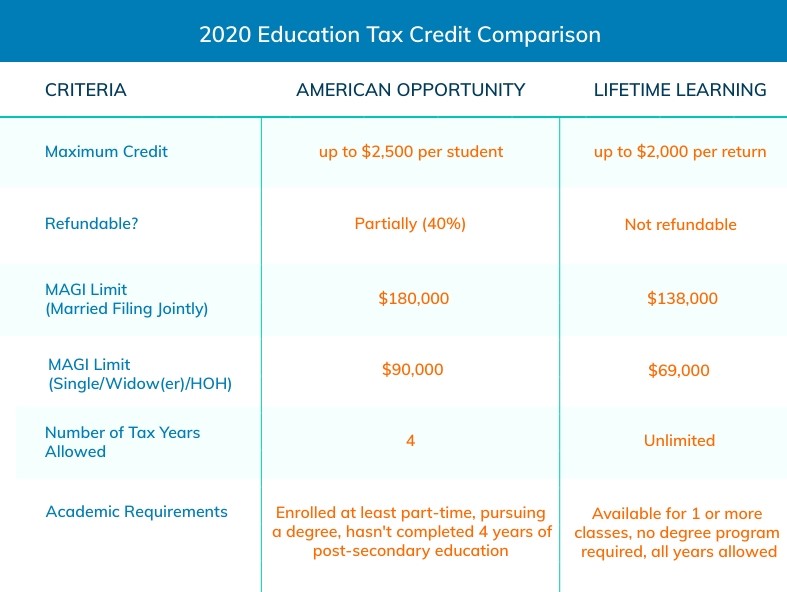

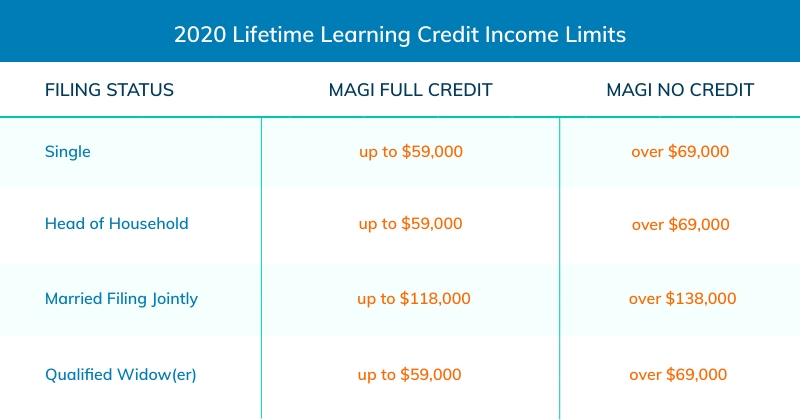

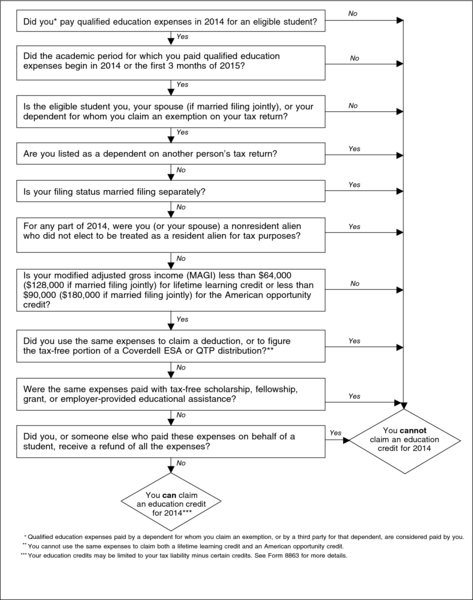

Your filing status is married filing separately. You calculate the lifetime learning credit by taking 20% of the first $10,000 of the qualified educational expenses you paid during the taxable year for all individuals. You must meet eligibility requirements to qualify for this tax credit.

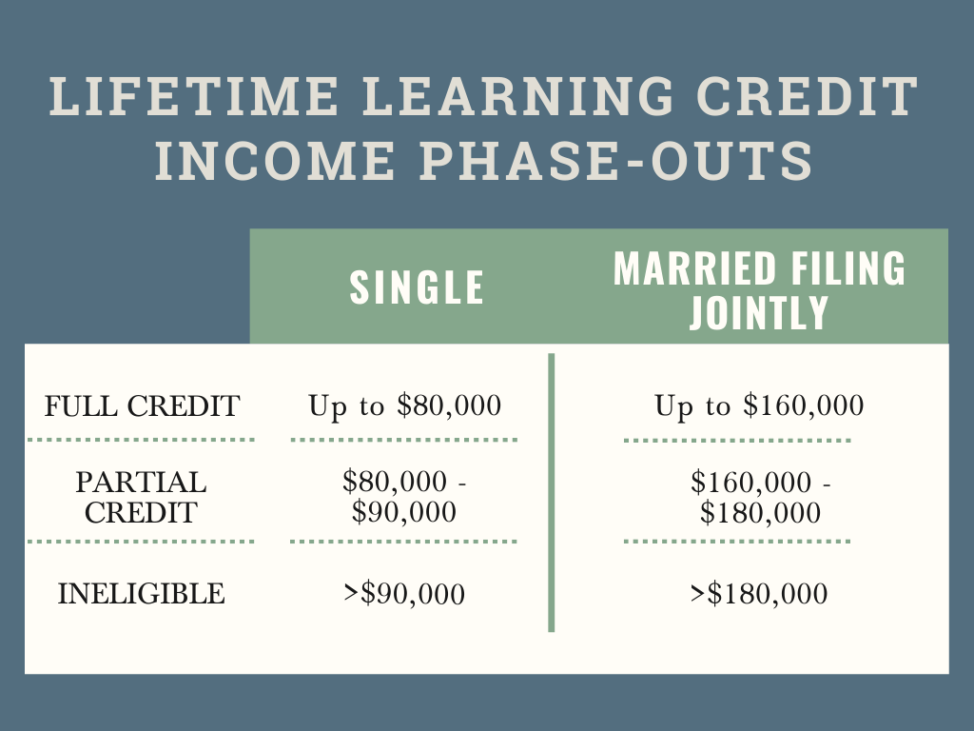

You, your dependent or a third party pay the education expenses for an eligible. How to apply for the lifetime learning credit by boris tomson posted in finance: To claim the full credit, your modified adjusted gross income (agi) must be $58,000 or less as an individual, or $116,000 or less if you and your spouse are filing a joint return.